Paul B Insurance for Beginners

Table of ContentsSome Ideas on Paul B Insurance You Need To Know4 Easy Facts About Paul B Insurance DescribedFacts About Paul B Insurance UncoveredAll about Paul B InsuranceExamine This Report on Paul B InsuranceThe 8-Second Trick For Paul B InsuranceThe Basic Principles Of Paul B Insurance

They can be appealing due to the fact that they have lower costs. Usually, individuals with these kinds of strategies do not recognize that the strategy they have bought has more restrictions than typical health insurance coverage, which their strategy will not truly cover the services they need. People with this sort of coverage can still be seen at UCHealth-affiliated facilities.

Restricted Benefits and also Practitioner/Ancillary Only strategies are not constantly easy to recognize and the cards these strategies provide to their members are usually complicated. Restricted Advantages Plans go by lots of names, consisting of, however not restricted to: minimal benefits strategies, practitioner-only plan, physician-only strategy, and so on. Limited Benefits Plans additionally usually use a method called "independent rates," which indicates the plan attempts to determine to a healthcare facility or doctor just how much they should be paid for supplying health and wellness solutions to their participants, despite the fact that the strategy does not have an agreement with the hospital or physician.

Furthermore, Restricted Advantages Strategies might inform their participants that they can most likely to any kind of health center they desire or use any physician they select, but that does not imply that the plan is in-network with UCHealth. Wellness Shares are offer minimal protection as well as compensation for restricted services. In other words, they pay very little for very few sorts of solutions.

Some Known Factual Statements About Paul B Insurance

Wellness Shares may appear like health insurance, they are not. Often, people with these types of strategies do not recognize that the strategy they have acquired is not health and wellness insurance, which their plan will not really cover the solutions they require. Individuals with this type of "protection" can still be seen at UCHealth-affiliated centers, however we do not get prior consents or costs them on part of individuals.

If the patient wishes to seek compensation from their Health Share, they will require to work with the plan straight. If people need a detailed statement of their solutions, or else called an Itemized Statement, people can submit an Itemized Statement demand online or call us. Wellness Shares are not always very easy to determine, as well as the cards these strategies offer to their participants are usually complicated.

In some cases the strategy cards do clearly state that the strategy is not medical insurance. Furthermore, Health and wellness Shares might inform their members that they can go to any type of hospital they want or utilize any doctor they select, however that does not indicate that the strategy is in-network or approved by us.

What Does Paul B Insurance Mean?

Some insurance coverage plans call for participants to utilize particular labs, or to acquire a reference or permission before particular sorts of care.

Cathie Ericson Sep 27, 2020 When selecting a wellness insurance coverage plan, it is necessary to recognize just how much you may need to pay out of pocket each year.

What Does Paul B Insurance Mean?

When you're choosing a wellness insurance policy plan, it's crucial to know it will original site fit your demands. If you need help, make use of the Plan for Me device.

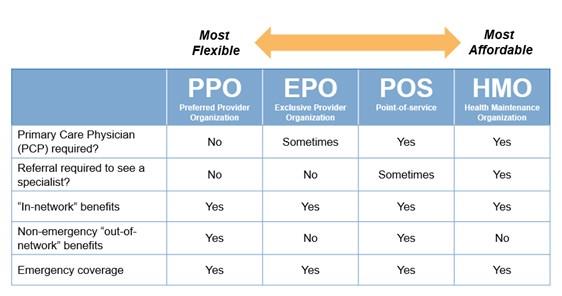

If you're purchasing a wellness plan, odds are you have actually found the terms HMO, PPO, as well as EPO. While there are lots of various kinds of wellness prepares around, these are amongst the most extensively acknowledged. Below's a quick evaluation of their attributes to assist you identify which type of strategy might be.

A Biased View of Paul B Insurance

Network suppliers are the physicians, other health and wellness treatment companies, and medical facilities that a health strategy agreements with to provide medical care to its members. A copyright that isn't gotten with the strategy is called an out-of-network supplier. Depending on the kind of strategy you select, you might be needed to choose (or mark) a PCP to provide and coordinate your treatment.

With an HMO strategy, you must pick a PCP. Your PCP will certainly offer checkups and routine treatment and issue references when you require to see a professional. You'll need to use doctors as well as health centers that are in the plan's network. Out-of-network solutions are covered only for urgent treatment and also emergency situations.

10 Easy Facts About Paul B Insurance Shown

PPO means Preferred Provider Organization. With a PPO strategy, you can visit any type of doctor or hospital in or out of the network without a referral. You'll pay much less when you use continue reading this in-network doctors as well as hospitals and pay more when you use out-of-network ones. For more in-depth info, checked out What is a PPO? With a PPO plan, you're covered when you use service providers both in as well click for source as out of the network.

With a PPO plan, you are not needed to select (or designate) a PCP. If you do, they will serve as your individual physician for all routine as well as preventative wellness treatment solutions. You will save money making use of an in-network vs. out-of-network PCP. PPO strategies use a few of the greatest versatility of all wellness strategy types.

You normally have a minimal quantity of time to choose the most effective health and wellness insurance coverage prepare for your family members, but rushing and picking the incorrect coverage can be pricey. Below's a start-to-finish overview to assist you find cost effective medical insurance, whether it's with a state or government market or through an employer.

How Paul B Insurance can Save You Time, Stress, and Money.

If your company uses health insurance coverage, you won't need to utilize the government insurance coverage exchanges or industries, unless you intend to search for an alternate plan. Plans in the market are most likely to set you back even more than plans provided by employers. This is due to the fact that most employers pay a section of employees' insurance costs.

By restricting your options to companies they've contracted with, HMOs do tend to be the most inexpensive kind of health and wellness strategy. An advantage of HMO as well as POS strategies is that there's one main medical professional managing your general treatment, which can result in better knowledge with your needs as well as continuity of medical documents.